NCBA Group has registered a profit after tax of Kshs 9.8 billion in its first half results end June 30 2024. The profit after tax represents a 5% increase in compared to earning posted during a corresponding period in 2023.

The profit before tax for the Group’s banking sector was Kshs 11.7 billion. The Group’s total operating income in period under review stood at Kshs. 31.4 billion.

The Group’s operating expenses grew to 16.5 billion, representing a 15.5% year-on-year growth.

The strong performance came despite macroeconomic challenges.

Non-banking subsidiaries contributed Kshs 600 million, a 56% increase in profitability. In addition, the lender continued to contribute to financial inclusion through the disbursement of Kshs 478 billion in loans via its digital platform.

NCBA’s recent acquisition of AIG Kenya strengthened its position in the country’s financial services sector. The transaction allows the bank to tap into the Kshs 309 billion insurance market.

The results comes as Fitch Ratings, a US-based credit rating agency, downgraded the NCBA Bank Kenya credit rating from ‘B’ to ‘B-’. The downgrade was attributed to the bank’s significant exposure to the country’s sovereign debt.

“The economic outlook for the latter half of the year presents a nuanced blend of optimism and caution. We are encouraged by the Government’s commitment to support sustainable growth, to maintain fiscal discipline, and to continue fostering a favorable financial environment,” NCBA Group MD and Chief Executive Director said on Thursday 22 August.

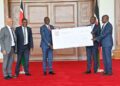

Following the positive results, NCBA’s directors approved the payment of Kshs 2.25 interim dividend for ordinary shares.

Related: KCB Group Half-Year surge by 86%